I remember when I was a kid, there was a man in front of me in the POSB ATM queue who forgot to take his receipt before he left. Before I threw it away, I couldn't help but sneak a glimpse at the receipt, and I remember being awed by the account balance I saw - over $180,000!

For those of us who are a bit more financially-savvy, it is a common goal to aim for $100,000 in savings before we are 30 years old. Of course, as Budget Babe, I hope I can reach this goal sooner by starting earlier and saving more. But when I talk to many of my friends about savings, many often shrug me off with how they aren't able to save as much as investment bankers.

"I earn too little"is but a lousy excuse. Comparing ourselves to investment bankers is even worse. If you're that unhappy about how much your current job pays you, then go ahead and work in an investment bank!

The truth is, it really isn't that hard for a fresh graduate to save $100,000 before he or she reaches 30. The problem lies in how badly we want to achieve this, and lack of action most of us take towards achieving it. But it is not impossible.

If you're like me, and investment banking is not really your cup of tea, here's how we can still do it.

1. Aim to save 50% of your take-home pay.

This is much easier to do than it sounds. Assuming a monthly salary of $3,200 (the median salary for fresh graduates in 2014, i.e. more than 1 in 2 graduates earn this amount):

Getting $1,280 to spend each month doesn't require you to give up your social lifestyle or to scrimp like a beggar. In fact, remember when we used to only spend $500 a month during our university days?

2. Save your bonus (instead of spending it).

Too often, many of us jump at a luxury item to reward ourselves at the end of a long working year once our bonus comes in. If you're able to exercise some self-discipline and put that straight into your savings account instead, you'll be able to increase your savings much faster.

3. Park your money in a good savings account.

Most of us financial bloggers have (some) of our money in a OCBC 360 savings account, which offers 1% interest rate if you direct credit your salary via GIRO each month, and another 0.5% if you pay at least 3 bills monthly via your account.

You can easily chalk up 3 bills by paying for your (i) telco bill (ii) monthly insurance (iii) other bank's credit card.

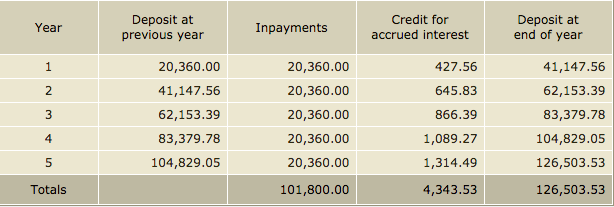

Assuming an annual interest of 1.5%, your savings in 5 years will look somewhat like this:

If you've only just started working (age 23 - 26), that's$126,500 in savings alone before you even hit 30!

Of course, the hard part is in being disciplined. But as you've just seen, you don't have to be earning an investment banker's salary in order to save that much. An average graduate salary will suffice, and most jobs today will be able to give you that.

Instead of complaining about how little we earn, let's first start by controlling our spending. Furthermore, the 20s are our best years to save, before the financial commitments of having a family and house mortgages start kicking in.

Growing rich is not an overnight affair. But if we start small and stay disciplined, I believe we'll get there together.

P.S. Budget Babe didn't start off with a $3,200 salary, nor do I receive any yearly bonuses. If I can save $20,000 a year, so can you :)

With love,

Budget Babe