Tired of having to jump through hoops to earn bonus interest? Check out Dash PET, where you can easily get S$150 on your first S$10,000 within a year once you sign up and activate the FREE protection plan.

By now, the world has accepted that we are going to be in a low interest rate environment for at least the next few years.

With the ever-changing rates, if you want to maximise how much you're getting on your savings or liquid cash funds, you might want to review the market offerings at least once a year to see what will give you the most bang for your buck.

While there are plenty of accounts out there that will reward you with bonus interest when you credit your monthly salary or spend a minimum amount on your card(s), the problem is that not everyone may be able to execute these actions.

- For instance, gig economy workers and self-employed business owners would likely have trouble meeting the first requirement, given that they don't always draw a monthly salary.

- For savvy consumers who ace their credit card game, they may not want to use the qualifying cards either because it may not give them the best rewards, cashback or miles for their spending.

If you're one of those struggling to fulfil these, there's still another great solution you can consider: Dash PET.

Why Dash PET?

In the current market, Dash PET offers the highest interest rate on your funds without requiring you to take extra actions every month. (As compared to current insurance savings plans available for subscription.)

For those who are new to Dash, it is a collaboration between Singtel Dash and Etiqa Insurance. Dash PET was launched to resounding success earlier this year, and functions as an insurance savings plan for people to park their funds in.

Its rates have been extremely competitive, especially when you compare to other options available for consumers to choose from. If you didn’t catch the first round at 1.7% p.a., don’t worry, because Dash PET is now giving 1.5% p.a. with free insurance coverage, which is also a pretty good deal.

Simply sign up and activate your free (TPD) protection to get 1.3%* + 0.2%* p.a. on your funds.

That means you'll be getting S$150 on your first S$10,000 with no lock-in period, and the flexibility to withdraw your funds anytime.

I've tested it out myself, and it is super easy to transfer funds between your Dash PET and Dash wallet or bank account.

What's more, I've reviewed Dash PET against other online insurance savings plans and no other competitor gives you this high for so little effort. Only one alternative comes close, and that requires you to spend at least S$500 monthly on your card to maintain the bonus interest paid.

Which might not be feasible for many people, especially folks like me who believe only in using credit cards that give me 2-in-1 rewards i.e. cashback or miles on my actual spend, on top of bonus interest on my deposits with the financial institution. The card has to make it to my list of top cashback/miles cards in the first place in order for me to use it for the purpose of earning extra bonus interest on my savings, especially in this current market.

The good news is, you don't have to even think about this with Dash PET.

What coverage will I be getting?

The main benefit of parking your funds in insurance savings plans is that your capital is guaranteed and protected by SDIC. Some insurers also offer life protection and/or COVID-19 cover in today’s circumstances.

With Dash PET, without even forking out any extra cents, you'll be getting free coverage based on 5 times of your first S$10,000 in account value.

That means if you deposit S$5,000, you'll be covered for S$25,000 against Death & Total and Permanent Disability. If you deposit more than S$10k, you'll be protected for S$50k.

Do note that the payout will be provided for accidental death if total and permanent disability cannot be provisioned. This is free for your first Dash PET policy year, with charges applicable at prevailing rates thereafter (you’ll be notified) if you wish to maintain the cover.

Once you’ve filled in your details and submitted, it should take no more than a few days for your policy to be activated, and you’ll be able to see the updated status on your dashboard.

Can I get a higher rate?

Yes. If you want to earn even more interest up to 2.25%* p.a., you can also opt for additional coverage (provided that they're suitable for you) to boost your interest up to an additional 0.75% per year. You can get up to 0.25%^ p.a. returns for each of activated add-on protection.

There are 3 insurance plans that you can add on:

- Major Cancer

- Death & Total and Permanent Disability (TPD)

- Accidental Death

What's the catch?

These rates are pretty rare in today's environment, especially for an online product.

Your first S$10,000 will earn 1.5%* in total once you sign up and activate the free insurance. Above and beyond that, you'll be earning 0.3%* p.a.

Of course, given how attractive this is, each consumer is also limited to only S$30,000.

Note that you'll have to also maintain at least S$50 in your account value at all times.

If you have more than S$30,000 in emergency funds, I suggest that you may want to spread them out across different accounts to maximise what you get on them.

Who is Dash PET good for?

Anyone who is looking to save their emergency funds in a high return, low risk product would find this useful. There are few comparable options that will give you this rate of return.

Since your capital is guaranteed, there's no need to worry about unexpected drawdowns either. Folks who like stability and having their money protected by SDIC will find this attractive.

Or, if you're a student looking for affordable insurance coverage on top of your savings, Dash PET is a great way to get started. You can start from as little as S$50!

I remember being stressed out about paying my insurance premiums when I was a first-jobber, because there wasn't such bite-sized insurance products available back then. If Dash PET existed during my time, I would have definitely have gotten it.

Where do I sign up to get 1.5%* p.a.?

Simply download the Singtel Dash app to get started. It'll take you through an easy, online sign-up process (get your ID card ready for verification) and then you're done!

Don't forget to opt in for the free protection so you'll get the bonus 0.2%* on your savings!

|

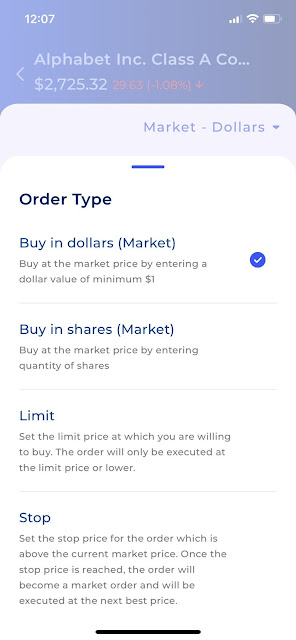

| Screenshot from Singtel Dash app |

Sponsored Message

Use promo code DASHBABE when you sign up for the app and get up to $20 cashback in 1 October to 30 November 2021. Here’s how it works:

Sign up for Dash PET (with a minimum of $5,000 and activation of the free protection) and get $10 cashback.

For the remaining $10 cashback, make an eligible transaction within 30 days (e.g. minimum $3 eligible payment or minimum $100 remittance) and get $3. The second remittance transfer of minimum $100 will get you another $7.

Disclosure: This post is written in collaboration with Singtel Dash.

Disclaimers:

The information is meant purely for informational purposes and should not be relied upon as financial advice.

*For the first policy year, 1.30% p.a. up to S$10,000 and 0.30% p.a. for subsequent amount in Account Value. Crediting rate is non-guaranteed.

*Additional 0.2% p.a. to the existing 1.3% p.a. returns for your first S$10,000 Dash PET savings during the first policy year while the complimentary protection is active. Complimentary Accidental Death coverage will be offered for the same sum duration if you are not eligible for this add-on protection. Sum assured will be based on your age and occupation.

*Additional interests of up to 0.25% p.a. from each activated payable add-on protection applies to the first S$10,000 account value of your active Dash PET policy.

Dash PET is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting interest rate. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

This advertisement is for general information only. Full details of the policy terms and conditions can be found in the policy contract on dash.com.sg/dashpet. Terms apply.

Protected up to specified limits by SDIC. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is accurate as at 12 October 2021.