It is no secret that I'm a huge Taobao fan - after all, I'm that bride who saved tons of money by purchasing my wedding stuffs on Taobao, including my customized wedding gown! I've written about my Taobao wedding purchases here and here previously, and have been using SGShop for my purchases since 2016.

Well, with all the upcoming baby expenses, I've also been shopping around diligently and doing lots of window shopping at Mothercare and Kiddy Palace, among other shops, to compare prices and quality. What I've discovered is that many of the items sold locally are priced at a premium, and I've actually been able to find the same - if not extremely similar - products on Taobao instead, therefore saving me tons of money!

While there are still some items that I'll get in person locally - such as a UV steriliser and a car seat for safety reassurances - I've found Taobao to be cheaper by far for many of the items I feel we will need for our baby. Even after factoring in shipping costs, many of these items cost much lesser than those at baby fairs here!

Without further ado, here's my Taobao shopping list and haul:

Baby Shower Net

Afraid that baby might slip out of your hands during shower time? Use a baby shower net to eliminate any chances of baby slipping or even hitting his/her head so you no longer have to dread bathtime!

![]()

Price: S$4.50

Link: here

Baby Rompers

Get those made from pure cotton as some babies may have sensitive skin.

![]()

Price: S$2

Link: here, here and here.

Baby Towels

You'll need lots of these for wiping off milk spills and baby saliva. Choose among these absorbent gauze / cotton / bamboo fibre ones from Taobao.

![]()

![]()

Price: S$2

Link: here, here and here.

Baby Sling

Got no money for a Tula? Missed Aviva's promotion for a free Tula with their maternity insurance packages? Fret not, you can get cheaper and stylish baby slings here as well! This design comes with a baby seat to offer more support as well.

![]()

Price: S$18

Link: here

Waterproof baby bedsheets

So that the mattress underneath remains clean, dry and unstained. Can use for baby's bed or even on your own (to absorb any leaking breastmilk!). These ones are washable so you can easily reuse them as well.

![]()

![]()

Price: S$2.25

Link: here and here, or get a bigger sized one here.

Crib Storage Organiser

All you need for changing baby within this nifty organiser for putting diapers, wet wipes and more. I see similar models retailing in Singapore shops for much higher prices!

![]()

Price: S$18

Link: here

Baby Cot

Been eyeing the gorgeous baby cot featured on Zoe Raymond and Naomi Neo's Instagram page? So was I...until I found out that the cot retails for $1,500 and they were sponsored for it anyway. If you're not keen to spend so much, here's a close substitute on Taobao that you can consider for 1/7 of the price.

![]()

![]()

Price: S$200

Link: here and here

Baby Gym

Perfect for hours of entertaining your baby while you get other tasks done, this baby gym will also train your baby's motor skills while having fun in the meantime.

![]()

Price: S$11

Link: here

Baby Bib (for meals)

Great for avoiding a mess during mealtimes as it catches falling food.

![]()

Price: S$2.25 each

Links here, here, here and here.

Belecoo Baby Stroller

I love this baby pram for its ability to transform from a horizontal crib into an upright seat, which sees your baby through his/her newborn days all the way till they're a toddler. I've seen the same strollers being sold by third-party retailers here in Singapore for 2 to 3 times of its price, so you might as well buy straight from Taobao and use all that savings to get your other baby essentials instead.

Lightweight, foldable and with a reclining / upright option, this baby stroller also takes heavy weights so you don't have to worry about the pram toppling over!

![]()

![]()

Price: S$52

Link: here

Dual-function Maternity & Breastfeeding Pillow

This will be a lifesaver for mummies when you hit your second trimester and your baby bump grows so big that you can barely sleep easy at night due to the discomfort. Cushion it and sleep easier with the help of a maternity pillow, which will support your baby bump and even out the weight distribution.

Most maternity pillows are big and bulky (my bed doesn't have space for that!) so I wasn't very keen on getting one initially, until I found this dual-function model that can double-up as a breastfeeding pillow, or even for baby to lie on!

![]()

Price: S$13.50

Link: here

Maternity Photoshoot Outfits

Get your maternity outfits for cheap on Taobao for a photoshoot to commemorate your pregnancy journey - after all, you only get pregnant a few times in your life!

![]()

Price: S$13 and up

Link: here

Diaper Bag

Skip the jujube and go for a much more affordable diaper bag that is equally (if not more) stylish and easier to match with your fashion outfits.

This is a must-have whenever you bring baby out. It is important to look for one that is waterproof and with many compartments inside so that you can fit all the diapers, milk bottles, baby wipes, baby towels, change of clothes, etc.

![]()

Price: $11.15

Link: here

*** Sponsored message below ***

SGShop is celebrating its 7th birthday this August, and they've lined up tons of freebies and promotions to share with all of us, making it the perfect time for you to check out your items and save on shipping and service fees!

![]()

Key promotions that I reckon are worth taking advantage of during their birthday month:

Well, with all the upcoming baby expenses, I've also been shopping around diligently and doing lots of window shopping at Mothercare and Kiddy Palace, among other shops, to compare prices and quality. What I've discovered is that many of the items sold locally are priced at a premium, and I've actually been able to find the same - if not extremely similar - products on Taobao instead, therefore saving me tons of money!

While there are still some items that I'll get in person locally - such as a UV steriliser and a car seat for safety reassurances - I've found Taobao to be cheaper by far for many of the items I feel we will need for our baby. Even after factoring in shipping costs, many of these items cost much lesser than those at baby fairs here!

Without further ado, here's my Taobao shopping list and haul:

Baby Shower Net

Afraid that baby might slip out of your hands during shower time? Use a baby shower net to eliminate any chances of baby slipping or even hitting his/her head so you no longer have to dread bathtime!

Price: S$4.50

Link: here

Baby Rompers

Get those made from pure cotton as some babies may have sensitive skin.

Price: S$2

Link: here, here and here.

Baby Towels

You'll need lots of these for wiping off milk spills and baby saliva. Choose among these absorbent gauze / cotton / bamboo fibre ones from Taobao.

Price: S$2

Link: here, here and here.

Baby Sling

Got no money for a Tula? Missed Aviva's promotion for a free Tula with their maternity insurance packages? Fret not, you can get cheaper and stylish baby slings here as well! This design comes with a baby seat to offer more support as well.

Price: S$18

Link: here

Waterproof baby bedsheets

So that the mattress underneath remains clean, dry and unstained. Can use for baby's bed or even on your own (to absorb any leaking breastmilk!). These ones are washable so you can easily reuse them as well.

Price: S$2.25

Link: here and here, or get a bigger sized one here.

Crib Storage Organiser

All you need for changing baby within this nifty organiser for putting diapers, wet wipes and more. I see similar models retailing in Singapore shops for much higher prices!

Price: S$18

Link: here

Baby Cot

Been eyeing the gorgeous baby cot featured on Zoe Raymond and Naomi Neo's Instagram page? So was I...until I found out that the cot retails for $1,500 and they were sponsored for it anyway. If you're not keen to spend so much, here's a close substitute on Taobao that you can consider for 1/7 of the price.

Price: S$200

Link: here and here

Baby Gym

Perfect for hours of entertaining your baby while you get other tasks done, this baby gym will also train your baby's motor skills while having fun in the meantime.

Price: S$11

Link: here

Baby Bib (for meals)

Great for avoiding a mess during mealtimes as it catches falling food.

Price: S$2.25 each

Links here, here, here and here.

Belecoo Baby Stroller

I love this baby pram for its ability to transform from a horizontal crib into an upright seat, which sees your baby through his/her newborn days all the way till they're a toddler. I've seen the same strollers being sold by third-party retailers here in Singapore for 2 to 3 times of its price, so you might as well buy straight from Taobao and use all that savings to get your other baby essentials instead.

Lightweight, foldable and with a reclining / upright option, this baby stroller also takes heavy weights so you don't have to worry about the pram toppling over!

Price: S$52

Link: here

Dual-function Maternity & Breastfeeding Pillow

This will be a lifesaver for mummies when you hit your second trimester and your baby bump grows so big that you can barely sleep easy at night due to the discomfort. Cushion it and sleep easier with the help of a maternity pillow, which will support your baby bump and even out the weight distribution.

Most maternity pillows are big and bulky (my bed doesn't have space for that!) so I wasn't very keen on getting one initially, until I found this dual-function model that can double-up as a breastfeeding pillow, or even for baby to lie on!

Price: S$13.50

Link: here

Maternity Photoshoot Outfits

Get your maternity outfits for cheap on Taobao for a photoshoot to commemorate your pregnancy journey - after all, you only get pregnant a few times in your life!

Price: S$13 and up

Link: here

Diaper Bag

Skip the jujube and go for a much more affordable diaper bag that is equally (if not more) stylish and easier to match with your fashion outfits.

This is a must-have whenever you bring baby out. It is important to look for one that is waterproof and with many compartments inside so that you can fit all the diapers, milk bottles, baby wipes, baby towels, change of clothes, etc.

Price: $11.15

Link: here

*** Sponsored message below ***

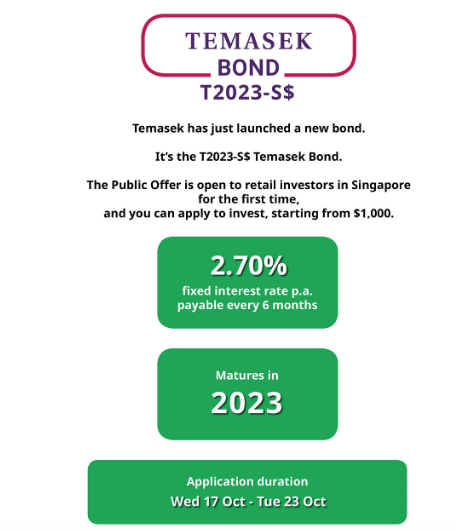

SGShop is celebrating its 7th birthday this August, and they've lined up tons of freebies and promotions to share with all of us, making it the perfect time for you to check out your items and save on shipping and service fees!

Key promotions that I reckon are worth taking advantage of during their birthday month:

- 13 - 30 August: free / agent fee capped at $17

- 1 - 31 August: enter the jackpot with every purchase made! There will be 3 tiers of prizes available - 7 winners get $70 coupons, 700 winners get 70% off service fees, while another 70 will get 10% off normal sea shipping!

Which option should you pick? Buy-for-Me, Ship-for-Me, or SmartShop?

Here's an easy guide to help you decide:

Buy-for-Me | Ship-for-Me | SmartShop | |

If you are… | Not fluent in Mandarin and need a third-party to help liaise on your behalf Need to customize your item or enquire about features | Looking to save money on service fees Fluent in Mandarin to communicate with sellers directly on Taobao | Looking to only make payment once. Items already have estimated weights so shipping fees can be factored in right from the start. The SmartShop items are marked by the blue S logo on the top right corner of listings. |

You get | Service fees includes inspection to ensure quality and spot defects | The option to add on inspection fees | No surprises in shipping fees |

Ordering process | 1. Order and pay for the cost of the product + Chinese domestic delivery. 2. Item arrive at SGShop warehouse in China, where it’ll be inspected and weighed for international shipping to Singapore. 3. You will then be prompted to make a second payment to SGshop for international shipping + 4 - 8% service fees + $0.98 customs clearance. 4. Opt for self-collect or home delivery at a fee. This method involves 2 – 3 rounds of payment (China-to-China, China-to-Singapore and Singapore domestic shipping). | 1. Shop and pay through Taobao’s own site. 2. Enter SGShop Guangzhou warehouse address as the delivery destination. 3. Submit your order details with the relevant information such as the Taobao order ID and delivery tracking number on SGshop’s website 4. When the items arrive at SGShop warehouse, they will be weighed to calculate the shipping cost. You will then be prompted to make payment to SGshop for the shipping from China to Singapore + $0.98 customs clearance. 5. Opt for self-collect or home delivery at a fee. | 1. Browse under the Smartshop Featured Items tab here. 2. Add to cart and check out. 3. Make payment, which includes product price and international shipping. 4. Choose the collection or delivery method once items have arrived in Singapore. |

If you're a first-time user, here are some promo codes I've consolidated for you to take advantage of:

- Click here for $5 free via my referral code (with no minimum spending!)

- "WELCOME50" for 50% off service fees

- "SGBUDGETBABE10" for 10% off economy air shipping

Have fun shopping!

Disclaimer: The bottom portion is a sponsored message by SGShop to get the word out about their services. All reviews and recommendations above are that of my own and sourced through my own time browsing and shopping online. I've been a satisfied customer of SGShop since I've started using them many years ago, and have previously shared about how their customer and warehouse team was a big help when it came to customizing my wedding gown and other items.

If you use my referral code for $5 free, I'll get $5 too! :) you can also share your own referral code with your friends and family afterwards so each of you get $5!

Do also note that all of the Taobao items above are sourced by myself over the past few months and were not recommended by SGShop. If you've any more great Taobao finds to share with fellow parents in Singapore, please feel free to leave me a comment below with the links and I'll be happy to look at adding them to this list!

If you use my referral code for $5 free, I'll get $5 too! :) you can also share your own referral code with your friends and family afterwards so each of you get $5!

Do also note that all of the Taobao items above are sourced by myself over the past few months and were not recommended by SGShop. If you've any more great Taobao finds to share with fellow parents in Singapore, please feel free to leave me a comment below with the links and I'll be happy to look at adding them to this list!

With love,

Budget Babe