|

| Image credits |

How many times have you sought advice from a "financial advisor" (i.e. mostly a glorified term for an insurance salesperson), only to be left sorely disappointed when they end up selling you insurance products (usually expensive / high commission plans)? You'll hardly find agents who tell you about "no commission" products that are actually great for various needs (eg. CPF-SA, Singapore Saving Bonds, Temasek Bonds, Astrea IV bonds, etc).

And so you try to DIY your own insurance through portals like CompareFirst, but you're also stuck because you cannot figure out if you're identifying your own insurance protection gaps correctly. As a result, you either end up under-insured (from DIY-ing wrongly), over-insured (if you listen to your insurance salesperson), or even worse, not getting insured at all (!!!!).

To try and address this problem, a joint venture was set up between NTUC Enterprise Co-operative and Providend Holding (which owns DIYInsurance). Their aim is to reach out to individuals and families who need to save and invest, but are currently being under-served by banks and financial advisers.

The result is MoneyOwl, which purports to be Singapore's first bionic financial adviser - where human wisdom and technology come together to deliver financial advice that integrates national schemes (like CPF, MediShield, ElderShield, etc).

MoneyOwl recently approached me to try out and review their platform, so here's what I think:

1. Suitable for both the clueless and the savvy insurance consumer.

Click on Find Out What I Need to fill in your profile and get a preliminary analysis from their AI robot technology, which employs an algorithm to identify your protection needs and provides recommendations on what type of insurance products you might want to look at getting (as well as giving you the top 2 cheapest quotes).

If you already know your own insurance gaps and you're just looking to compare quotes, you can click on I Know What I Need to get started. That will bring you to this page:

Previously, consumers could compare on either DIYInsurance or CompareFirst (by MAS), but both portals were lacking in many areas such as having limited insurance products and a cap on coverage. If you wanted or needed anything else or higher, you would still have to go through an insurance agent to get the quote. I've reviewed both platforms previously here as well.

And if you need to speak with a human for a second opinion or to ask more questions about the recommendations provided to you, you can opt to be contacted via phone, email, web chats or even meet up face-to-face with MoneyOwl's team of licensed advisers.

2. Your insurance needs are sorted by your profile and life stage.

This is even better than DIYInsurance's previous Self Check tool, which I reviewed here and provided recommendations on what needed improving on.

|

| As most of you would know by now, I've hit 9 months of pregnancy and my baby is due to be born anytime now, so I tried out this tool using my new status as a parent. |

3. Your protection needs are determined by your life stage and number of dependents.

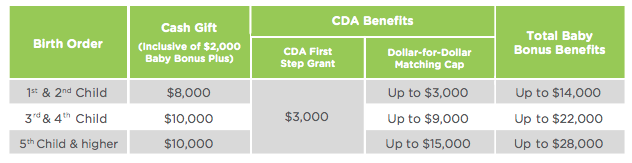

Regular readers will know that I'm in a tight spot because my husband and I have a pretty high number of dependents to look after - 5, to be exact - and we're alone in this. That number will probably grow to 6 soon because we're hoping to have a second child in the near future as well.

As a result, we cannot afford to just save and invest - we need to turn to insurance to help mitigate the larger (potential) bills in the event of any unfortunate incident as well, otherwise a single large bill for either one of our dependents could very quickly wipe out our entire cash savings and assets.

4. You can fill up your profile, and it is pretty non-intrusive.

Don't you hate it when companies ask for private and intrusive personal information like your name and contact number before they reveal a quote / other information to you? You just know that they're using it as a tool to follow up later and sell you something!

If you're such a consumer like me, then you'll appreciate how MoneyOwl doesn't require you to furnish them with personal identifiable details like your name or contact number. As long as you wish not to be contacted, you have the option to go through the entire process, get the recommendations and quote, and get out without worrying about a pesky salesperson calling you afterward.

But at the same time, if you do wish to be contacted and speak to an advisor for more details beyond what the tool is recommending you, MoneyOwl also allows you to create your profile and leave your email address so they can get in touch with you to either discuss further.

5. It not only identifies your insurance needs, but also allows you to add your existing coverage so that you can get an accurate assessment of what your remaining gaps are.

This was the coverage suggested for me:

And this is what I got after adding my existing insurance coverage:

My thoughts?

This is great and a huge game-changer for the insurance industry. I love the idea, the interface, and the fact that there's the option for consumers to speak with an adviser if they need additional support. After all, I still maintain that technology can never fully replace the empathy and emotional concerns that only a human adviser can relate to.

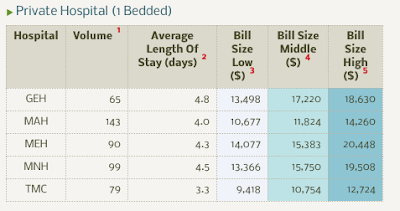

Another point of contention I brought up was that ranking hospital plans by cheapest premiums isn't necessarily a good way because the cheapest for this particular type of policy does not always mean the best value-for-money. AIA hospitalisation plans, for instance, may be more expensive than NTUC Income, but that's because the pre and post-hospitalisation coverage that they offer are a lot more as well. MoneyOwl then told me this is where the client assessment with their human advisers will come into play.

|

| Source: The Straits Times |

As most of you know, the biggest problem in the insurance industry is that there is little incentive for agents to recommend products with zero or low commission rates.

And is that really surprising, when agents rely on these commissions to earn a living? It is a well-known fact that commissions are fiercely guarded by the insurance industry - remember how in 2013 when 10 financial advisory firms pressured iFast Financial to withdraw insurance products from its Fundsupermart website which would have offered a 50% commission rebate to consumers?

As long as commissions continue to be tagged to agent recommendations, unbiased advice is but an idealistic dream that is mostly impractical in reality.

There is a lack of competent and conflict-free advice today that helps Singaporeans integrate CPF and other national schemes into their financial plans, probably because advisers don't earn any money for such advice with commissions or trailer fees. MoneyOwl seeks to fill this gap. Their client advisers are purely salaried employees, who will not receive commissions or incentives based on products / amount of premiums / number of policies sold. This removes the conflict of interest and leaves them free to dish out financial advice that is fitting to the consumer, such as topping up CPF, buying the Singapore Saving Bonds, investing in low-cost index funds, etc.

The cost of the products that will be recommended by MoneyOwl will be low, mainly because the product providers either pay no trailer fees at all to the distributors, or at most a small quantum of commission. Such solutions are not popular in financial advisory plans offered to the mass market (obviously!).

Investments will come with no sales charge, much unlike the investments that your insurance agent tries to sell to you, or the unit trusts recommended by your banker.

|

| Source: The Business Times |

I love what I'm seeing on MoneyOwl thus far, and look forward to their other services and improvements in the near future.

In the meantime, go ahead and try out MoneyOwl for AI-powered insurance advice or get quotes for yourself here!

Disclaimer: This post is sponsored by MoneyOwl to raise awareness about their latest revamp and offering. The review and all opinions written are that of my own.

With love,

Budget Babe